Today I am not going to post any chart as all the levels on either sides are still in tact and that too quite for sometime now. Nifty still could not manage to go above 4885/90 and menacingly not also has broken down the 4835/30 zone discussed earlier .As big B’day is here, will humbly request to trade less/nothing today. Immediate range of the market is still @ 4885/90-4830 and the broader range can be 4960/75 to 4750-4715/10. Traders able to match these levels in each time frame and co-relate them, only should trade, though it’s my personal opinion.

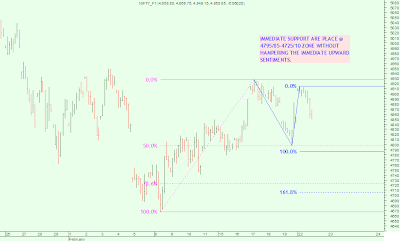

Supports: As told that all levels are in tact so 4835 is the support initially. Below that 4820 is mild one and 4808/4800-4785. Further breakdown can bring 4750-4715/10 positional supports.

Resistances: 4885/90 .. above that 4920/25. Further breakout will bring 4960/85.

Have a safe trading day and hope I do not have to post the same in coming week!! Need a direction badly now.

Read More

Supports: As told that all levels are in tact so 4835 is the support initially. Below that 4820 is mild one and 4808/4800-4785. Further breakdown can bring 4750-4715/10 positional supports.

Resistances: 4885/90 .. above that 4920/25. Further breakout will bring 4960/85.

Have a safe trading day and hope I do not have to post the same in coming week!! Need a direction badly now.